Tax Credit Info: Do course fees qualify for a 1098-T tax credit?

If you paid for a UCSC Extension course, you may qualify for a tax credit on your taxes. This page provides information to help you secure the correct education tax credit form. There are however, some common exceptions to eligibility, such as:

- If your courses did not provide academic credit. (Many of our courses and programs provide continuing education units (CEUs) or professional credit rather than academic units.)

- If your tuition and fees were entirely waived or paid entirely with scholarships or grants.

- If your tuition and fees were covered by a formal billing arrangement between an institution and the student's employer or a governmental entity, such as the Department of Veterans Affairs or the Department of Defense.

This information is not intended as legal or tax advice. Individuals should contact a tax adviser or IRS Publications, Forms and Instructions for more information concerning tax issues and benefits. UCSC Silicon Valley cannot provide tax advice. Here's some information at the Tax Benefits for Education: Information Center or Education Credits: Questions and Answers.

The IRS Form 1098-T, Tuition Statement

To get the required form—IRS Form 1098-T, Tuition Statement—please include your Social Security Number in your UCSC Extension Student Profile by the end of the calendar year.

The IRS Form 1098-T, Tuition Statement is used to help you determine your eligibility for an educational tax credit and/or deduction.

There is more information below for people who miss the deadline and still want to receive a 1098-T form.

Access Your 1098-T

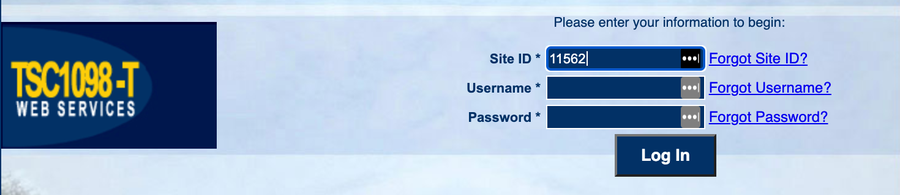

The University of California has contracted with the TAB Service Company to electronically produce your IRS Form 1098-T, Tuition Statement. You may have received an email notification from TCRS indicating that your 1098-T is available online at www.tsc1098t.com. Be sure to check your spam filter to make sure you receive this important tax statement. See directions below to help you log on and get your form.

Login Instructions for Your 1098-T, Tuition Statement

You will be required to log in to www.tsc1098t.com, a secure portion of the TAB Service Co. website to access your individual 1098-T information. Please read these directions before going to the site to avoid confusion. Enter the following information:

- Site ID for UCSC: 11562

- User Name: Student ID/Account number

- Default Password: Last 4 digits of your SSN (Note: If your SSN/ITIN is not on file with Extension, or if the last four digits of your SSN/ITIN do not work, please try 0000 (four zeros).

- Create a new password. For security reasons, you will then be prompted to change your password.

- View and Print. From your student record page, you will be able to view and print your 1098-T statement by selecting “View/Print My 1098-T Tax” and choosing “Print”.

If you need assistance accessing your record, please call (888) 220-2540.

Statement Errors

Upon receipt of your 1098-T statement, if there are errors, please contact UCSC Extension Student Services at (408) 861-3860. We will guide you to amend and reissue the statement.

Can’t find your 1098-T Statement?

If a Social Security number (SSN) was not entered into your student record by December 31, 2021, a 1098-T statement will not be available for you. If you would like to now provide that information to obtain a 1098-T Statement, please fill out IRS form W-9S and mail it to:

UCSC Extension, Office of the Registrar, 3175 Bowers Ave., Santa Clara, CA 95054

Please note: The University of California does not supply paper copies of 1098-T statements.